Dubai: The perfect destination to start your crypto business in 2025

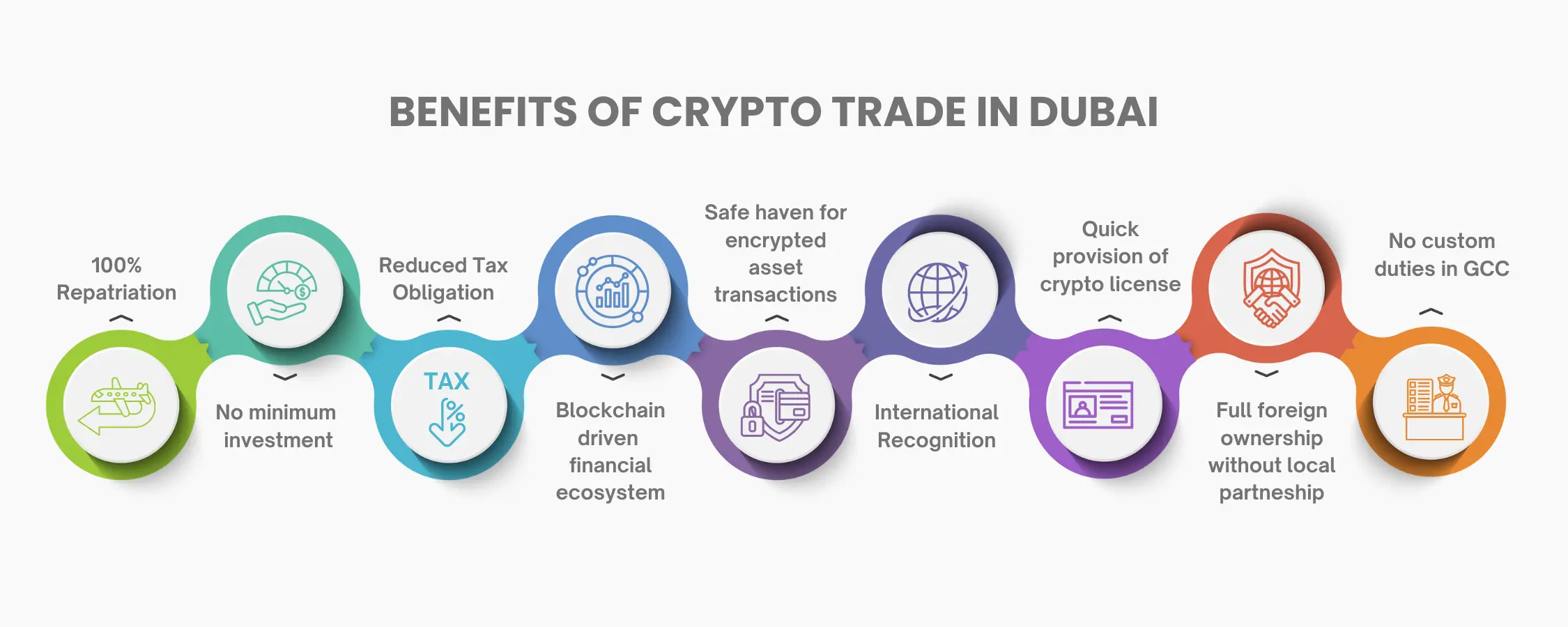

Dubai- a global hub for innovation with its forward-thinking policies has positioned itself as a global leader in managing crypto assets and enabling seamless commercial activities. As digital currencies become the cornerstone of modern finance, many investors and entrepreneurs across the globe are seeking ways to diversify their portfolios and tap into the booming world of cryptocurrency.Unlike countries such as India, the US, and China, where regulations often limit crypto ventures, Emirates offers a streamlined, business-friendly environment for starting a cryptocurrency business in Dubai.

Moreover it provides comprehensive cryptocurrency trading licenses in Dubai, with a thriving ecosystem and innovative infrastructure for startups and enterprises to flourish.

This blog will explore the unique advantages of starting a crypto business in Dubai, including process of obtaining crypto trading license in Dubai and information about documents required with its regulatory framework, supportive infrastructure, and tax benefits, and also on how entrepreneurs can unlock unparalleled opportunities in one of the most futuristic cities in the world.

What are cryptocurrency trades in Dubai ?

• A crypto business in Dubai refers to an entity involved in activities related to cryptocurrencies, such as trading, exchange, investment, or management of digital assets.

• These businesses form the core of the cryptocurrency ecosystem, encompassing cryptocurrency exchanges, digital wallet providers, crypto asset management firms, and blockchain technology companies.

• Their operations focus on facilitating the use, transfer, storage, and growth of cryptocurrencies through secure, innovative, and technology-driven solutions.

• Crypto businesses play a critical role in driving the adoption of digital currencies while offering a range of services tailored to individual and institutional users within the digital asset market.

How to Start a Crypto Business in Dubai

1. Register a legal entity and choose a name for a crypto business in Dubai.

The first step is to register an entity for your business and choose a unique name for your company, which has not been registered before.

2. Choose a jurisdiction

Choosing whether you want to open a representative office in Freezone or mainland both has its own advantages. Investors can enter free zones benefiting from taxes, regulations, and total ownership. On the other hand, the mainland allows you to do business with clients in old Dubai and other parts of the Emirates.

3. Obtain a crypto trading license in Dubai

Pick a crypto license registration form from the respective free zone authority where you wish to cater service and fill out the form. Leela International will support you as crypto business experts in obtaining the form and all other documentation work required.

4. Submit legal documents

Attach the relevant copies of passport, photocopies of shareholders, including business plan , financial plans and other documentation as per the requirement of local regulator.If everything is OK, then the company will get the license within a few months after approval.

5. Open a bank account and apply for a UAE residence Visa.

It is necessary to open a bank account with minimal capital to obtain a crypto trading license in Dubai facilitating easy transactions.

Essential requirements for launching a crypto trading business in Dubai:

1. Documents required:

- Passport copies

- Proof of Address

- Bank Reference Letter

- Business Plan

- Memorandum of Association

- Shareholder Agreements

2. A completely clean crypto wallet with no fraudulent activities.

3. Make your business capital resources & whole operational activities visible for a minimum of 6 to 12 months of operation.

4. A clean track record is compulsory, and no deceitful activities are permissible.

5. Regular audit and compliance review by VARA, whenever required.

6. Timely reporting of data such as financial reports, operational data and other information.

7. Maintain a high level of security of virtual data and client data.

Why is Dubai the ultimate destination for crypto trading?

BUSINESSES THAT REQUIRE VARA APPROVAL IN DUBAI:

The Virtual Assets Regulatory Authority (VARA) has outlined seven key activities for Virtual Asset Service Providers (VASPs) in Dubai, promoting flexibility and innovation. VASPs must secure a license before offering services and meet specific compliance requirements for each activity. Custody Services must operate as independent entities with separate licenses, while proprietary trading requires distinct companies.This framework ensures robust governance while fostering growth in Dubai’s evolving virtual asset sector.

Advisory Services:

This Service involves providing tailored recommendations to clients regarding actions or transactions involving virtual assets. These recommendations can be initiated by the advisory entity or requested by the client. Such services require a deep understanding of virtual asset markets, including trends, risks, and compliance requirements. Advisors must ensure their guidance aligns with regulatory frameworks and is based on thorough research to protect clients’ interests. In Dubai, offering these services mandates a license from the Virtual Assets Regulatory Authority (VARA).

Broker-Dealer Services:

Broker-Dealer Services involve facilitating Virtual Asset transactions, ensuring compliance with VARA Regulation II and the VA Issuance Rulebook. This includes arranging or soliciting orders for Virtual Assets, matching buyers and sellers, and handling transactions either as an intermediary or dealer for the entity’s account. Additional services include market-making with client assets and providing placement or distribution support for Virtual Asset issuers. These activities require strict adherence to transparency, AML/CTF standards, and fair market practices to maintain trust and market stability.

Lending and Borrowing Services:

This service involves facilitating agreements where Virtual Assets are loaned by one party to another with a commitment to return them within a specified timeframe. These services may include interest-based agreements and are governed by strict terms to protect lenders’ rights. Providers must ensure transparency, risk management, and compliance with regulatory standards, such as anti-money laundering (AML) measures, to maintain security and trust in these financial arrangements.

VA Management and Investment Services:

This service involves managing Virtual Assets on behalf of an entity, acting as an agent or fiduciary, and overseeing their administration or use. It includes investment management, optimizing portfolios, and staking Virtual Assets in proof-of-stake blockchain networks to generate rewards for validators or node operators. Entities providing these services must ensure robust governance, risk management, and compliance with VARA regulations to protect client assets and maintain transparency in all operations.

Transfer and Settlement Services

Transfer and Settlement Services involve facilitating the secure transmission of Virtual Assets between entities or to Virtual Asset wallets and addresses. These services ensure the efficient and accurate movement of assets while maintaining compliance with regulatory standards, including AML/CTF protocols. Firms engaged in this activity must prioritize security, transparency, and traceability to protect users and uphold market integrity in the Virtual Asset ecosystem.

Custody Services:

Custody Services involve the secure storage and management of Virtual Assets on behalf of clients, ensuring their safety from theft or loss. Firms offering these services are required to segregate assets, operate with stringent governance practices, and comply with VARA regulations. This includes providing clients with secure access to their assets while ensuring robust internal controls, including compliance with anti-money laundering (AML) and cybersecurity standards. Custodians must maintain high levels of transparency and risk management to protect both clients and the broader financial system.

CONCLUSION:

Starting a crypto business in Dubai presents unparalleled opportunities in one of the most dynamic and technologically advanced markets. With its robust regulatory frameworks, tax-free zones, and government-led initiatives like Blockchain Strategy 2021, Dubai is establishing itself as a global hub for blockchain and cryptocurrency companies.

Obtaining a crypto trading license in Dubai allows businesses to engage in activities such as trading, mining, and exchanging popular digital currencies like Bitcoin, Ethereum, Dogecoin, and Tether. These licenses not only facilitate lawful operations but also open doors to significant business opportunities and increased revenue streams.

Navigating the process of obtaining a crypto trading license and setting up a crypto company in Dubai requires expertise and strategic planning. This is where Leela International steps in as your trusted blockchain business consultant. With our deep understanding of Dubai’s business ecosystem, we provide end-to-end support, from document preparation to regulatory compliance and company registration. Whether you’re a seasoned investor or a new entrepreneur, our team ensures a smooth and hassle-free experience.

Embark on your journey to success in the cryptocurrency market with Leela International as your reliable partner. Together, we can transform your vision into a thriving crypto business in Dubai. Reach out today and unlock the limitless potential of Dubai’s cryptocurrency ecosystem.

Book Free Consultation

Maybe You Like

WhatsApp us